In This Section, we specify which G/L accounts we will use to record which taxes.

STEP 1: Following is the path For DEFINE G/L ACCOUNT FOR TAXES

STEP 2: Click on execute button to DEFINE G/L ACCOUNT FOR TAXES. ( Following type Window will Open)

STEP 1: Following is the path For DEFINE G/L ACCOUNT FOR TAXES

- IMG activity path : IMG > LOGISTIC GENERAL > TAX ON GOODS MOVEMENT > INDIA > ACCOUNT DETERMINATION > DEFINE G/L ACCOUNT FOR TAXES

- Transaction code : OB40

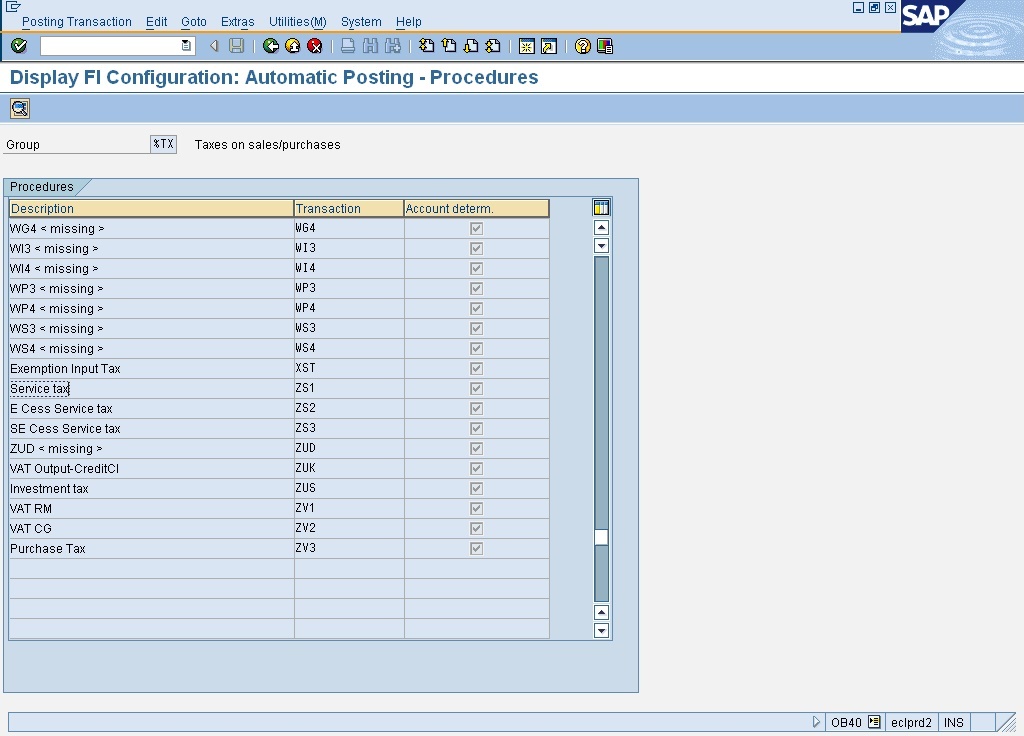

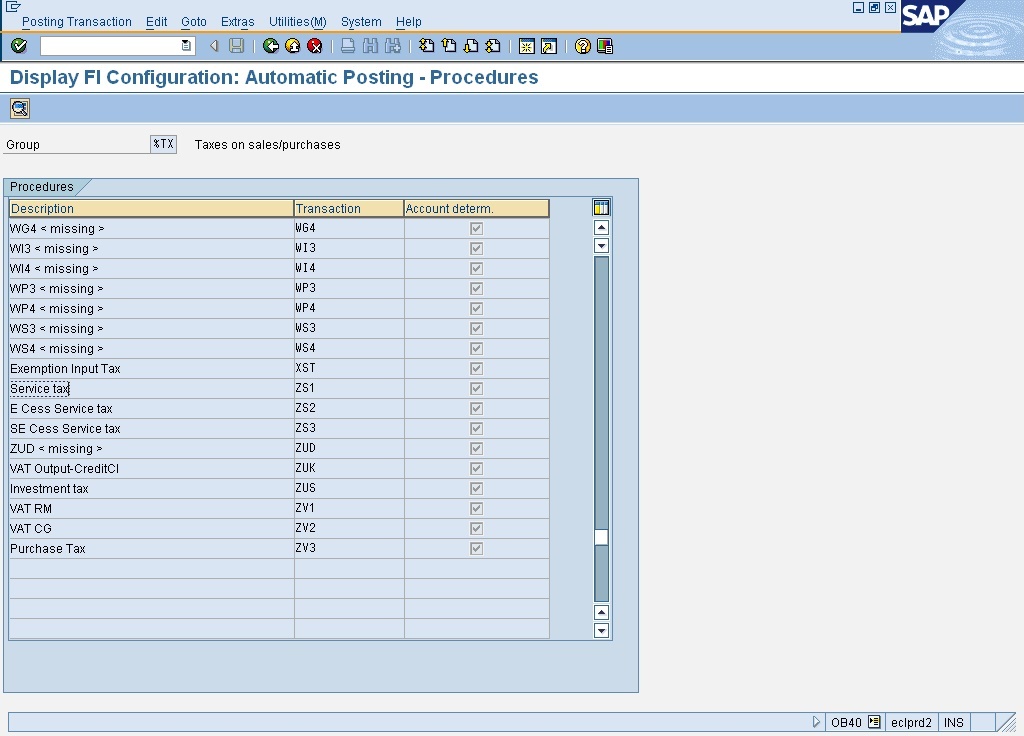

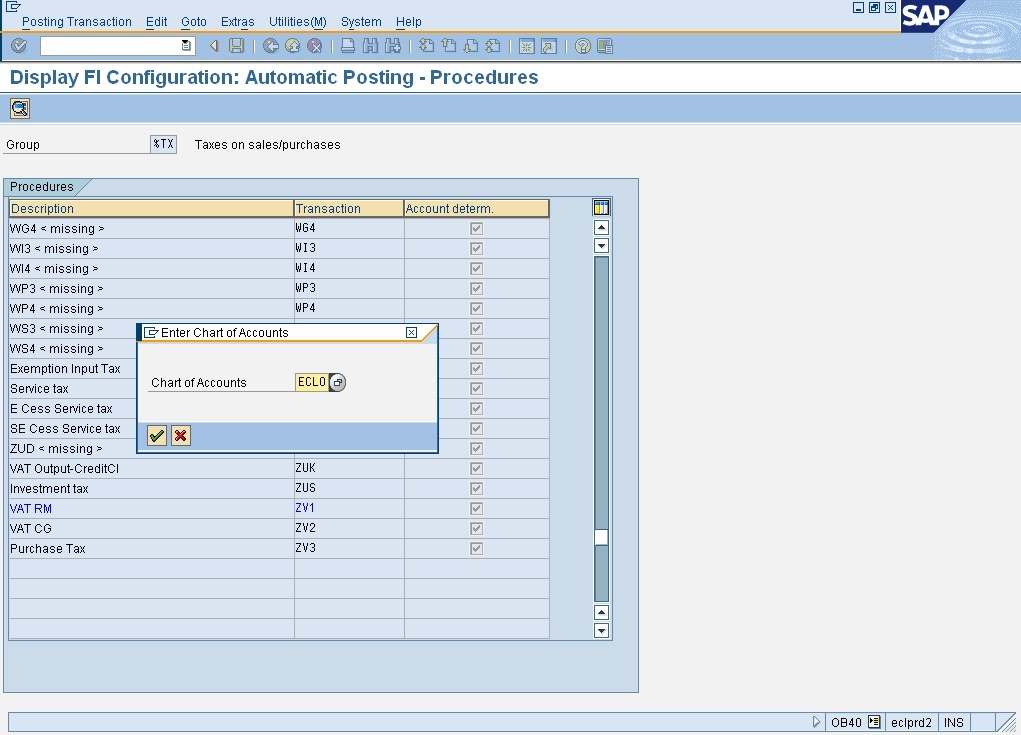

STEP 2: Click on execute button to DEFINE G/L ACCOUNT FOR TAXES. ( Following type Window will Open)

- Description : Name of the procedure or group of procedures for which automatic posting can be generated.

- Transactions Keys/ Event keys : The transaction keys are used to determine accounts or posting keys for line items which are created automatically by the system. The transaction keys are pre -defined in the system and cannot be changed by the user. Neither we can define the new keys.

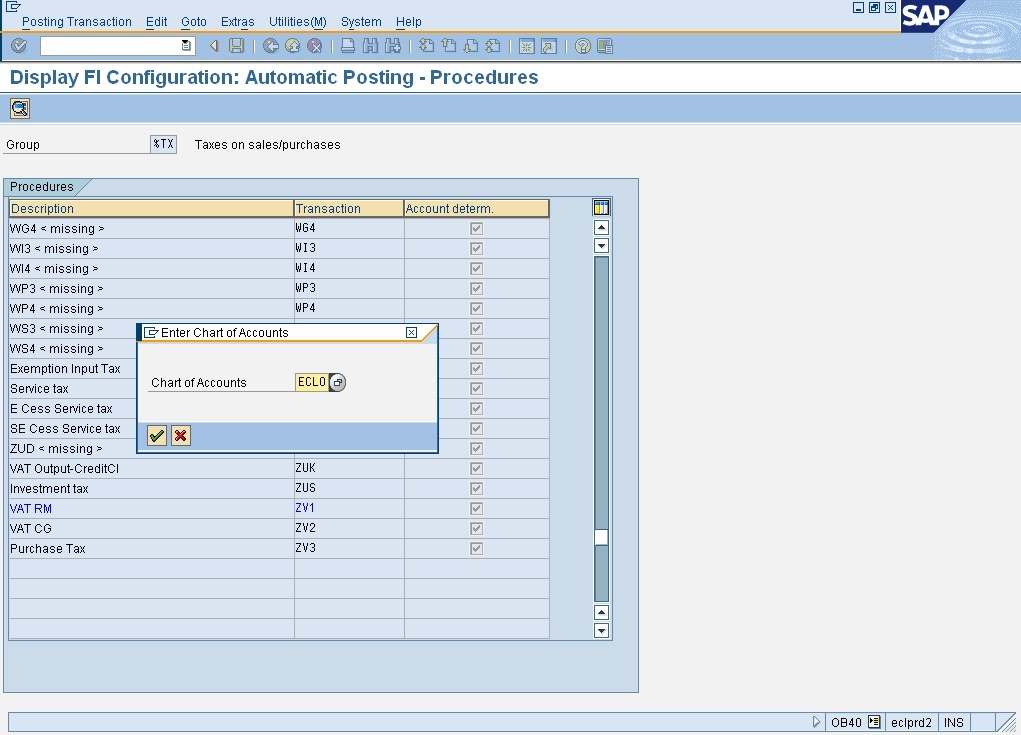

STEP 3: Then Double Click on Transactions . On Double clicking on the Tansaction Key we will get the following popup window. here we have to specify the Chart Of Account. You can use the F4 function to enter the Chart Of Account.

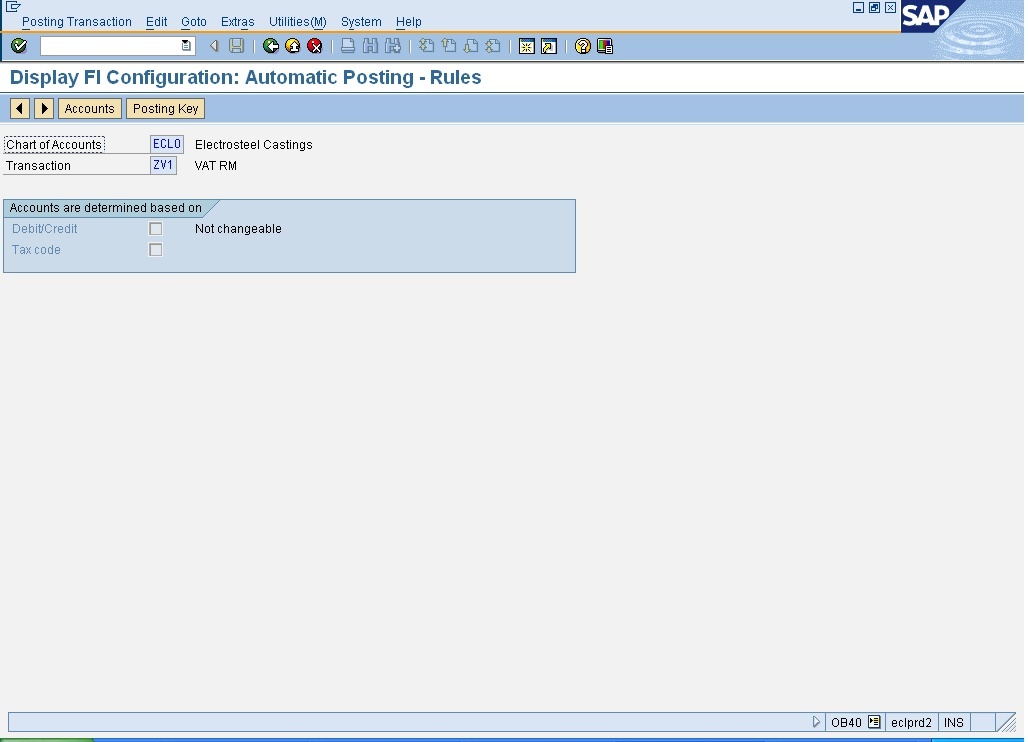

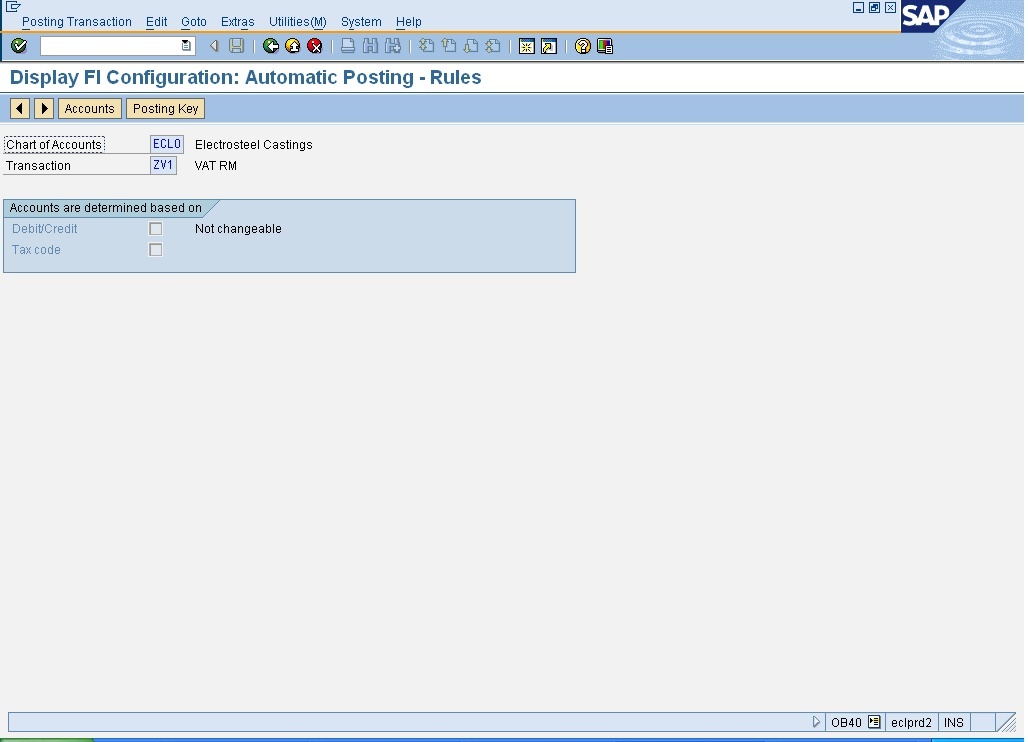

STEP 4: Enter the chart of accounts. Then press enter. We will get the G/L account where the tax amount flows. ( Following type Window will Open)

STEP 6 : By Clicking On the posting key You will see following window

Posting key is used by the system if a debit or credit posting is to be created.

A two-digit numerical key that determines the way line items are posted.

This key determines several factors including the:

STEP 7 : Now Click On Rules.

In Above Screenshot, You will see in screen where the G/L account "320610" has

been maintained for the transaction Key " ZV1".

- Transaction key : In our case it is "ZV1" & its description is " VAT RM" whereas

- G/L account : Our G/L account number is "320610".

Thus we can state that " The amount of VAT paid will flow to the G/L account =320610".

STEP 6 : By Clicking On the posting key You will see following window

Posting key is used by the system if a debit or credit posting is to be created.

A two-digit numerical key that determines the way line items are posted.

This key determines several factors including the:

- Account type

- Type of posting (debit or credit)

- Layout of entry screens.

STEP 7 : Now Click On Rules.

- Debit/Credit :

- Indicates that different accounts can be determined for debit and credit posting during account determination for the chosen procedure.

- TAX CODE : A two-digit code that represents the specifications used for calculating and displaying tax. It is a key that has a different meaning depending on the business transaction and which is used to differentiate account determination. The meaning is preset in the SAP system and cannot be changed. A mark in the Box allows you to specify the Tax Code along with the G/L account in which the posting of this Tax is to be done.

You’ve got some interesting points in this article. I would have never considered any of these if I didn’t come across this. Thanks!. taxfyle.com

ReplyDeleteI really thank you for the valuable info on this great subject and look forward to more great posts. Thanks a lot for enjoying this beauty article with me. I am appreciating it very much! Looking forward to another great article. Good luck to the author! All the best! how do i calculate my business taxes

ReplyDelete