Here we specify which excise accounts are to be posted to for the various transaction types. Enter all the accounts that are affected by each transaction type.

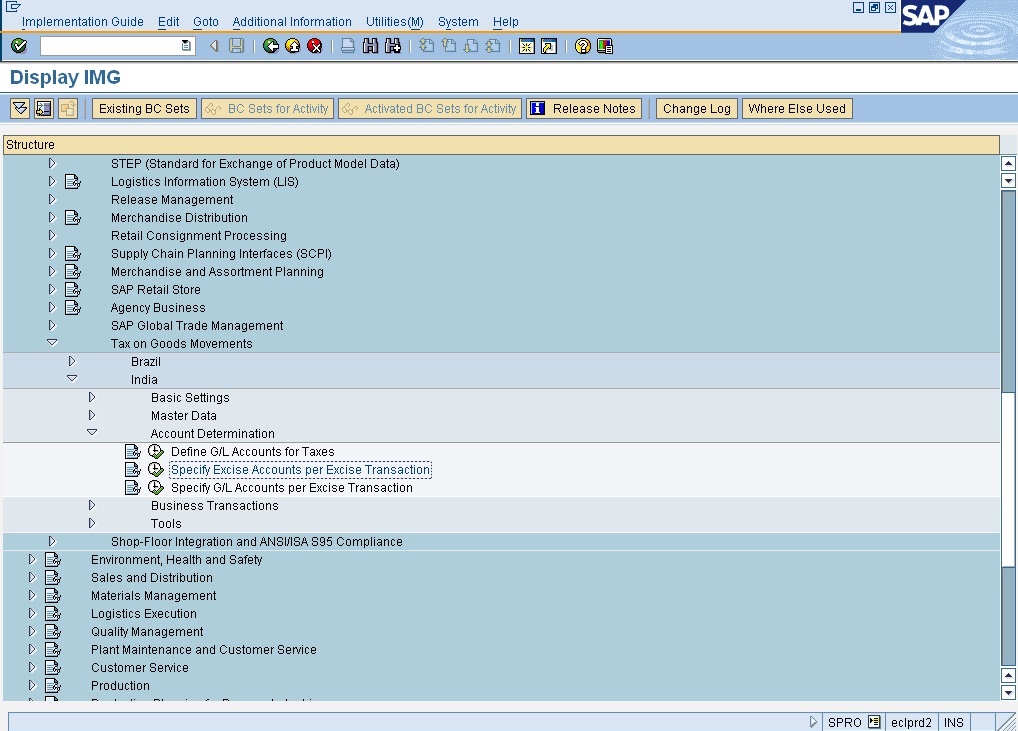

STEP 1: Following is the path For " SPECIFY EXCISE ACCOUNTS PER EXCISE TRANSACTION"

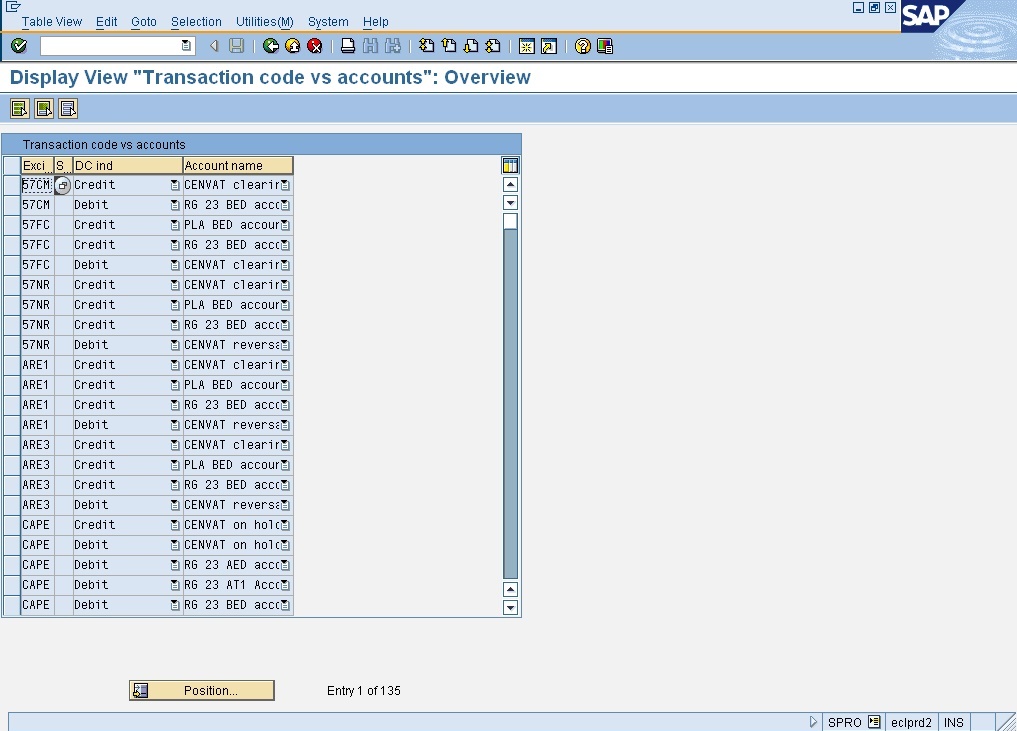

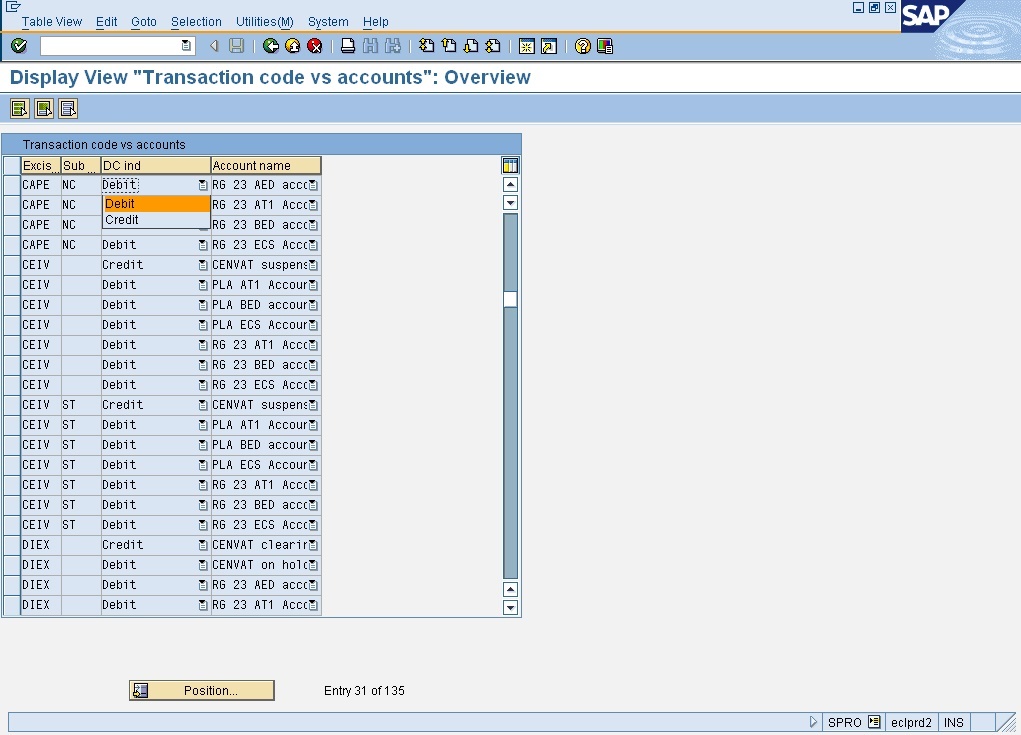

STEP 2 : Click on execute button to SPECIFY EXCISE ACCOUNTS PER EXCISE TRANSACTION Following Type Window Will Open

STEP 2 : Click on " New Entries" By clicking on " New Entry " you will see the following screen

STEP 3 : Select the Appropriate Exicse Transaction Type

Following are the Excise Transaction Types defined By the CIN

1) GRPO : Goods Receipt for purchase Order in Plant , also used in Depot for a P.O and Material Document.( USE :- Ex. Invoice is posted w.r.t P.O)

2) EWPO : Excise Invoice without Purchase Order..( USE :- Ex. Invoice is posted without any reference either to P.O or Material Document)

3) 57 FC : Subcontracting Challan

4) 57NR : Reversal & recredit of Subcontracting challan

5) CAPE : Capital Goods credit account( USE:Ex.Invoice is posted w.r.t P.O and 50% of these is to hold credit for next Financial year)

6) OTHR : Exicse Invoice for other movements

7) DLFC :Factory slae & Stock Transfer via SD

8) CEIV : Cancellation of generated exicse invoice

9) DIEX : Differential Excise Invoice Credit

10) MRDY : Exicse duty reversal without without reference

11) MRRD : Excise duty reversal if material used for non-production.

12) MRWO: Excise duty reversal for write off cases ( Code- J1IH , Excise JV)

13)TR6C : PLA account adjustment through TR6 Challan ( Code- J1IH , Excise JV)

14) UTLZ : Is used for detemining the accounts when a JV is posted with an optiomn of fortnight payment ( Code - J2UIN , Monthly Utilization)

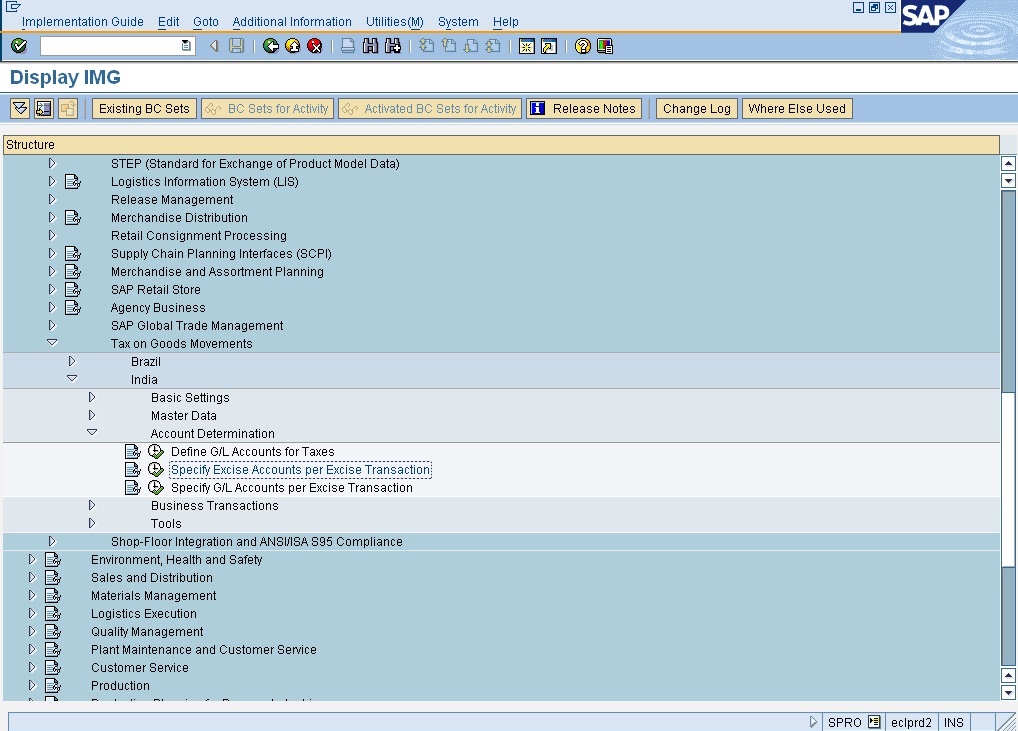

STEP 1: Following is the path For " SPECIFY EXCISE ACCOUNTS PER EXCISE TRANSACTION"

- IMG activity path :IMG >LOGISTIC GENERAL > TAX ON GOODS MOVEMENT > INDIA > ACCOUNT DETERMINATION > SPECIFY EXCISE ACCOUNTS PER EXCISE TRANSACTION

- Transaction code : SPRO

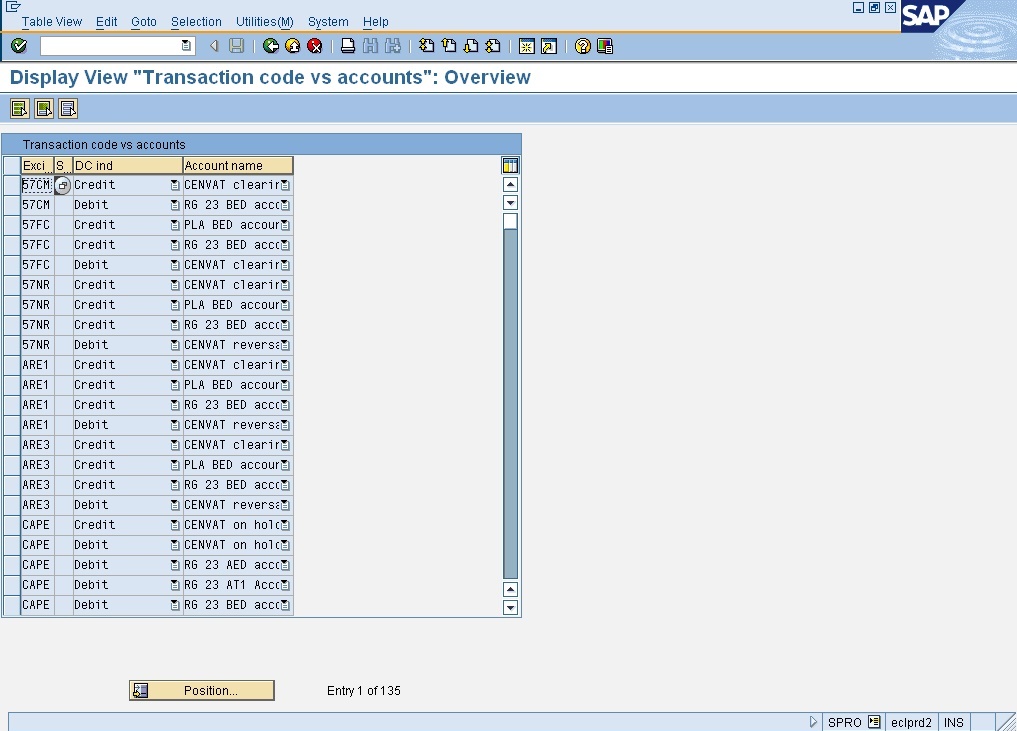

STEP 2 : Click on execute button to SPECIFY EXCISE ACCOUNTS PER EXCISE TRANSACTION Following Type Window Will Open

STEP 2 : Click on " New Entries" By clicking on " New Entry " you will see the following screen

STEP 3 : Select the Appropriate Exicse Transaction Type

Following are the Excise Transaction Types defined By the CIN

1) GRPO : Goods Receipt for purchase Order in Plant , also used in Depot for a P.O and Material Document.( USE :- Ex. Invoice is posted w.r.t P.O)

2) EWPO : Excise Invoice without Purchase Order..( USE :- Ex. Invoice is posted without any reference either to P.O or Material Document)

3) 57 FC : Subcontracting Challan

4) 57NR : Reversal & recredit of Subcontracting challan

5) CAPE : Capital Goods credit account( USE:Ex.Invoice is posted w.r.t P.O and 50% of these is to hold credit for next Financial year)

6) OTHR : Exicse Invoice for other movements

7) DLFC :Factory slae & Stock Transfer via SD

8) CEIV : Cancellation of generated exicse invoice

9) DIEX : Differential Excise Invoice Credit

10) MRDY : Exicse duty reversal without without reference

11) MRRD : Excise duty reversal if material used for non-production.

12) MRWO: Excise duty reversal for write off cases ( Code- J1IH , Excise JV)

13)TR6C : PLA account adjustment through TR6 Challan ( Code- J1IH , Excise JV)

14) UTLZ : Is used for detemining the accounts when a JV is posted with an optiomn of fortnight payment ( Code - J2UIN , Monthly Utilization)

STEP 4 : Select the Appropriate Sub Transaction Type : Specify if you want to post to any different account by using the Sub. transaction Type else leave it Blank.

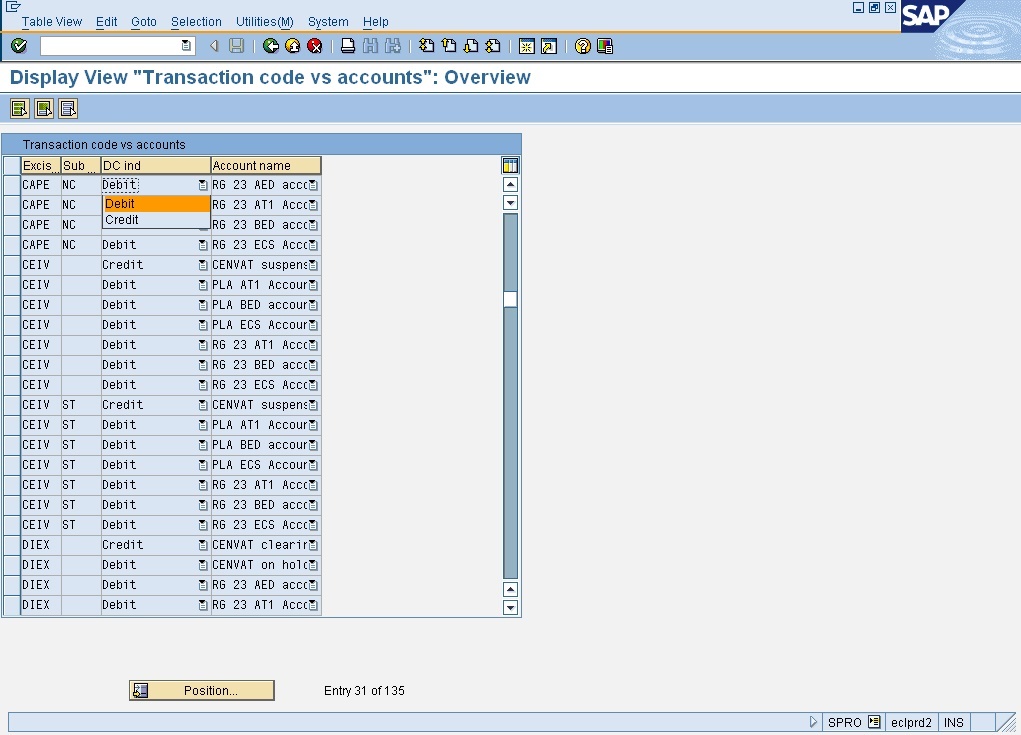

STEP 5 : Select the Appropriate Debit/ Credit Indicator : Specify weather the account is to be Debited or Credited. Here We have specified as Debit

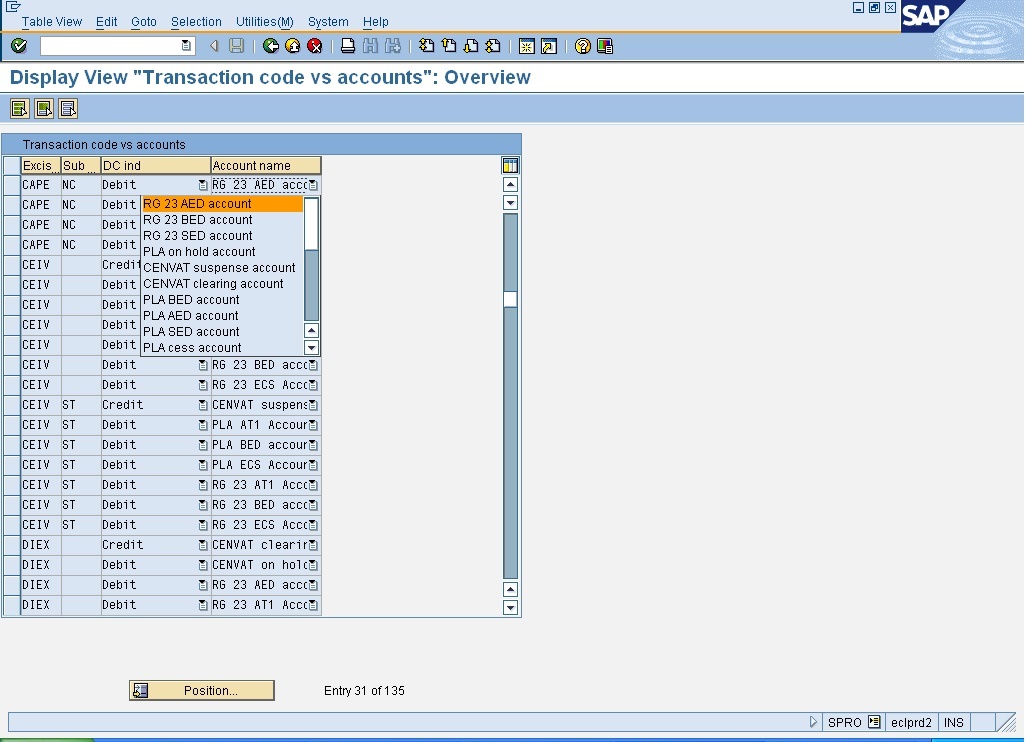

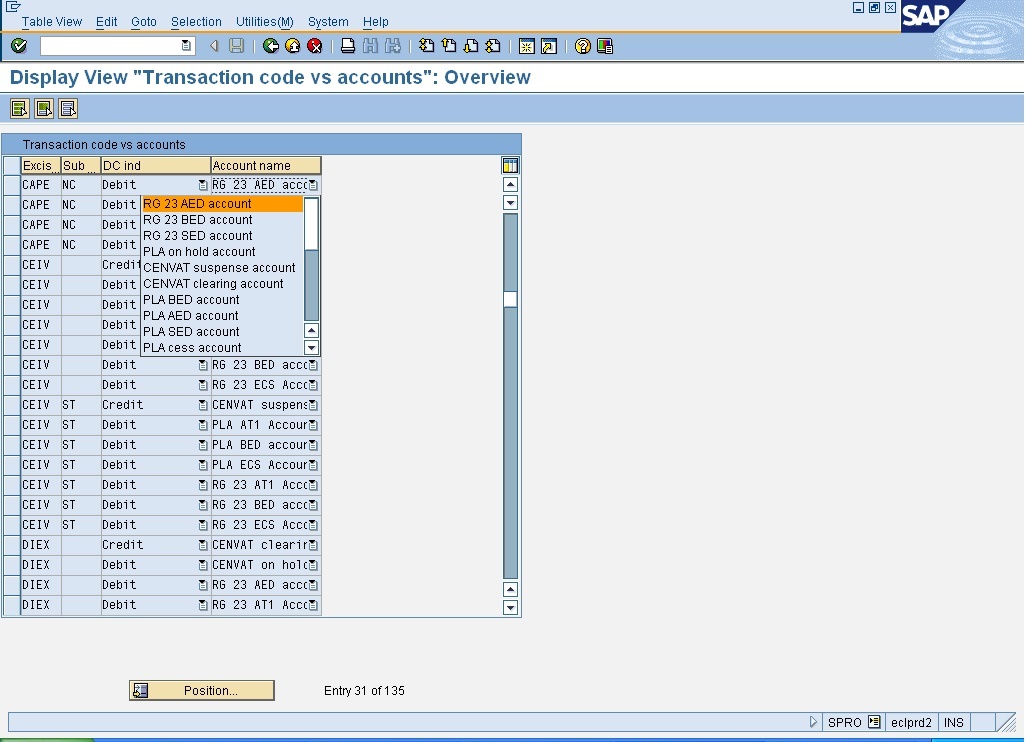

STEP 5 : Select the Appropriate Account Name : Here we have to select the account name . I have selected RG23 AED account

STEP 5 : Select the Appropriate Account Name : Here we have to select the account name . I have selected RG23 AED account

STEP 6 : Click on Save Button to store Configured data

Note

Note

- If we use subtransaction types, enter the accounts that are affected by each transaction type.

- If we use subtransaction types, enter the accounts for each subtransaction type as well.

- Transaction type UTLZ is used for determining accounts only while posting excise JV and also if the payment of excise duty has to be done fortnightly.

- The fortnight CENVAT payment utility picks up the credit side accounts from the transaction types of GRPO, EWPO, and TR6C for determining the CENVAT and PLA accounts. There is no separate transaction type for fortnightly payment.

0 comments:

Post a Comment