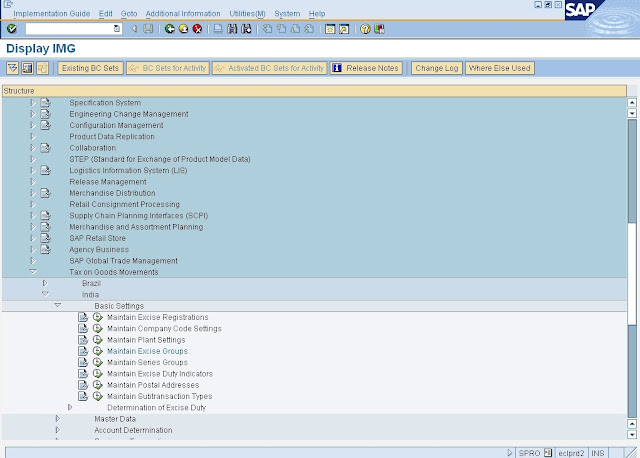

STEP 1: Following is the path For to Maintain the EXCISE GROUPS

- IMG activity path :

- IMG > LOGISTIC GENERAL > TAX ON GOODS MOVEMENT > INDIA > MAINTAIN EXCISE GROUPS

- Transaction code : SPRO

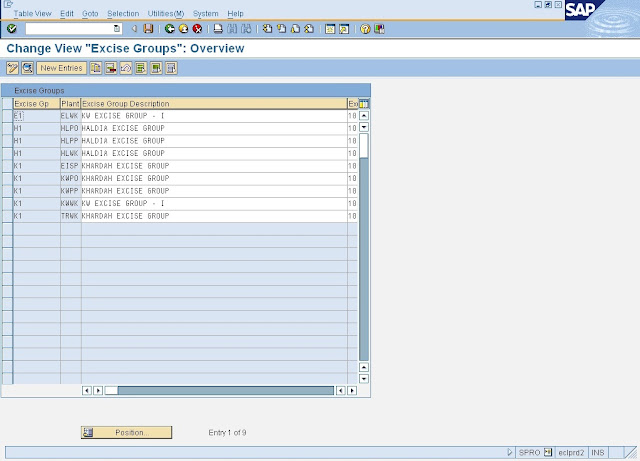

STEP 2: Click on execute button to Maintain the EXCISE GROUPS ( Follwoing type Window will open)

STEP 3: Then Click on New Entry ( after click following Screen Will Open)

STEP 4: Update the Following Data

- Give 2 digit character of your own choice.for EXCISE GROUPS

- EXCISE GROUPS : A unit within an excise registration, in India, which keeps its own set of excise records. Whereas the excise registration reports to the excise authorities, the excise group is a purely internal organizational unit. Each excise group keeps records of all transaction that have to be reported to the excise authorities. When the time comes to present these records to the authorities, the excise registration compiles the information from all of its excise groups.

- Plant : Enter the Plant Code which is registered to Excise Department as specified in one of the above slide.

- Description : Enter description for your Excise group as of your choice

- EXCISE GROUPS :

- Excise Regestration ID : This will be the same ID as we have

- maintained intially while Maintain Ex. Registaration

- Number of GR's per Ex. In. : Here we can specify weather we are allowed to receive more than one delivery per excise invoice, and if so,whether we can take the CENVAT credit immediately (Multiple Credits) or have to wait until the delivery has been made in full (SingleCredit).

- Default Challan Qty in GR : A mark in this Box will instruct the system to copy the Exicse Invoice Qty to Goods Receipt whenever we post Gr using reference document as Incoming Excise Invoice

- OUTGOING EXCISE INVOICES

- Excise Invoice during Billing : A mark in this chheck box will instruct the system to create the Excise Invoice automatically in background whenever we create a commercial OR performa Invoice

- Create and Post Invoice Single Step : A mark in this Box will instruct the system to verify & post the Excise Invoice that we create

- Part1 Posting Trigger

- CONSUMPTION : Automatically creates two entries in part I register RG 23A or RG 23C immediately we post a goods receipt for direct consumption, one entry to record the goods receipt, and one for the goods issue. Goods for direct consumption are not added to a material stock. The system posts them directly to a consumption account. We do not create a separate goods issue. The goods issue material document that causes the system to create the part I entry for the goods issue. This function overcomes that problem. When we enter a goods receipt for direct consumption, the system automatically creates two part I entries from the goods receipt document.

- (in Other word A mark in this Box wil instruct the system to create the 2 entries in Part 1 of RG23 A or RG23 C as we post the GR for Direct Consumption. Since for direct consumption we dont create GI document , here system uses GR document only to create 2 entries in Part 1 register.)

- DEPOT SETTINGS

- Depot Indicator :

- A mark in this Box will indicate for the particular combination of the Excise group & Plant the Plant will function as a Depot

- Note : There is difference between the Depot indicator at Plant level & at Excise group level. Plz see the above setting's made at Plant level. Plant level setting always precedence over other.

- Folio Numbers: A mark in this check Box will automatically generate the FOLIO Number when we post a GR or GI that are recorded in RG23D register. ( Depot are required to maintain RG23 D register) Folio number range has to be maintained by using the transaction "J_1IRG23D".

- Depot Excise Invoice : A mark in this Check box will instruct the system to automatically verify and Post the Excise Invoice which are created for other movements i.e : movement of FG material from Plant to Depot.

- ADDRESS DETAILS

- Address : Here we have to specify the Organisation postal address

- MIGO SETTINGS

- EXCISE INVOICE CAPTURE : Enable us to capture incoming excise invoices when we enter goods receipt in the standard goods movement transaction (MIGO) This applies to manufacturing plants and depots alike. We enter goods receipt details and the excise invoice information at the time of GR. When we save the goods movement, the system automatically saves the excise invoice, to be posted later using the incoming excise invoices transaction.

- Post Excise Invoice in MIGO: Mark in this Box enables the user to post Incoming and Outgoing Ex. Invoice in " MIGO".It also enables Depot user to Post Excise Invoice in "MIGO".

- Duty different at GR : Mark in the Box enables the user to post the Incoming Ex. Invoice in MIGO even though they have changed the Duty in Ex. Invoice tab.If box is kept unmarked and user changed the duty then it is not possible to Post the Ex. invoice , but it get captured

- EI create/RG 23D SELECTION IN MIGO : Enable us to create outgoing excise invoices in manufacturing plants using MIGO when they enter a goods issue in the standard goods movement transaction. It also enables us in depots to select the appropriate RG 23D entries when they enter a goods issue.

- UPDATE RG1 AT MIGO : Creates an entry in register RG 1 immediately we create an outgoing excise invoice in the standard goods movement transaction, MIGO, if the goods in the excise invoice are finished goods. Otherwise the RG 1 entry is not created until we execute the register update program. RG 1 is used for the finished goods that we have transferred from the factory to a store. It also shows any sales of these goods

- IN OTHER WORD : Mark in the Box instruct system to create an entry in RG1 register when MIGO is used to outgoing Finished Goods. If Box is unmarked , then we have to execute the Register Update Program to create entry in RG1.

- RG1 :- Is a register which is used only for Finished Good movement . It include the goods moved from Plant to Depot & Sales of these goods

- COPY TO GR : Instructs the system, when we post a goods receipt using an incoming excise invoice as a reference document, to copy the excise invoice quantity to the goods receipt.

- DUTY DIFFERENCE : Enable us to post incoming excise invoices in the MIGO, even if any of the excise duty information have been changed in the excise invoice tabs. Otherwise the transaction will only allow capturing the excise invoice

STEP 5 : Click on Save Button to store Configured data

0 comments:

Post a Comment